Market and Market Structure: In common assertion, market refers to a particular place where goods and services are purchased and sold by manufacturers or produces at wholesale or retail prices. Thus, the market is a place that consists of several small size shops and big shops, stalls and a number of hawkers selling different types of products and services. In a market, there are two parties who use to facilitate the process associated with the exchange of product and services. Among these two parties, one stands as a seller and another one stands as a buyer. A market might be physical in form, like a wholesale or retail outlet where people gather and communicated face-to-face and get involved in purchase and sale, or virtual such as an online market where no physical contact established between the sellers and buyers but goods are exchanged. However, in Economics, the market is not just a particular place but it denotes a market which is solely associated with commodities.

As per economic term, market refers to a specific arrangement whereby sellers and buyers come close and contact with each other indirectly or directly to buy and sell goods or services. Furthermore, it also says that for a market’s existence, sellers and buyers do not need to meet with each other personally at a specific place and they might contact or communicate each other by using any means of communication such as fax, telephone or mail. Thus, in economics ‘Market’ is a term that used in a specialised and typical sense and it does not indicate a pre-fixed location. It indicates to the entire area of operating supply and demand. Again, it means the conditions as well as the commercial relationships between sellers and buyers those who are involved in facilitating transactions. Therefore, the term market signifies all kind of arrangements in which the purchase and sale of goods and services take place. Our Assignment Help UK experts will explain you this with the help of infographics.

Definition of Market and Market Structure

Antoine Augustin Cournot, a French economist has defined the market as not a particular place of market from where things are sold out and bought but the entire area of a region where the sellers and buyers involved in such intercourse with each other that the end prices of the same products and services tend to easily, equality and quickly. This particular definition of the market indicates some essential points such as a market is not any specific place where sellers and buyers use to assemble but it might be an area or region which belongs to a particular country, state, district or even the entire world from where sellers and buyers are drawn. There must be business intercourse among the dealers, i.e., buyers and sellers. Along with this, another point rises which says that the buyers and sellers need to be in touch with each other to become aware of the prices accepted or offered by other sellers and buyers, and the same price rules the market during the same thing same time.

On the other side, as per some other definitions of the market as provided by different scholars market refers not only to a place but also to the commodities as well as the sellers and buyers of commodities who are involved in competition with one another directly. From different definitions of market, some facts are identified that there are always some commodities exited in a market, sellers and buyers get in touch or communicate with each other either through telegraph, telephone, post, or through some middlemen, and there is always a perfect competition exists among sellers and buyers and due to such competition, final or selling price of commodities get influenced. There are different types of market depending upon the degree of competition, and the presence of buyers and sellers. Moreover, market structures are also based on the nature of different markets.

The market structure stands as a set of characteristics of a market either competitive or organizational which describes the degree and nature of competition as well as the prevailing pricing policy in a market. Thus, market structure referred to the number of companies producing similar products and services and operated in a particular market and the structure of whom is determined as per the prevailing competition in that particular market. Structure of a market indicates the practices followed by market players i.e. the practices of the sellers and buyers present in a market. Now our experts from Assignment Writing Service will tell you about the determinants of market structure.

Major Determinants of Market Structure

- There are some major determinants which decide the structure and formation of a market. These major determinants of a market structure are as follows –

- The number of sellers selling their products and services in a market.

- The number of customers present in the market.

- The characteristics and nature of products and services selling by companies.

- The degree of concentration of a company shows its market shares i.e. the more a company becomes able to concentrate on a market the great it becomes able to hold market shares.

- Every market structure includes its own entry rules and exit barriers whereas some markets are free to enter and exit.

- The degree of combination between different operational stages of a company such as production, distribution is handled by a single company.

- The degree of differentiation in relation to products and services which says the way a company’s offerings use to differ from the offerings of other companies.

- The concept of economies of scale, which says a firm’s cost-efficient behaviour in terms of producing products or services by incurring less cost.

- The rate of customer turnover which is the volume of customers intending to change or switch their choices with respect to products and services while an adverse situation arises in a market.

- Thus, marker structure affects how a company prices its products and supply the same, how it handles all the barriers it faces while entering into a market and exiting from the market, and how efficiently it can carry out all its regular business operations.

Types of Market Structure and their Features

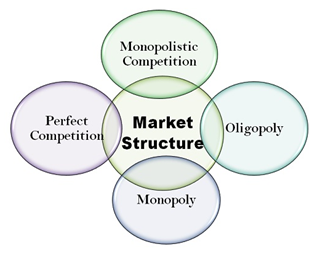

A country’s economy includes different types of market structures that indicate the depth of competition and the nature of the sellers and buyers associated with the market. The major determinants of different market structures include the nature of products and services, number of buyers and sellers, economies of scale and more. The four common market structures found in any economy are Perfect Competition, Monopolistic Competition, Monopoly, and Oligopoly.

In the perfect competition structure of a market, the number of sellers and buyers are large and all the sellers are small in size and they compete with each other. No big seller is present in a perfect competition market and that is why all the companies i.e. sellers act as price takers. The assumptions made while discussing perfect competition market are that the products purchased and sold in the market are completely identical i.e. homogeneous, every company aims to maximise their profit. The other assumptions include firms do not need to incur any cost for entering into the market and they are free to exit anytime without spending a penny, and customer preference not much entertained, absence of artificial restrictions and other trade-oriented government restrictions, absence of transportation cost, and buyers and sellers have perfect knowledge about technology and price of products.

Monopolistic competition is another market structure which is comprised of a huge number of sellers as well as buyers. The sellers do not sell identical or homogeneous products and services through the products and services are similar, all are slightly different from one another. Monopolistic competition is a real-world scenario of a market. In this type of market, buyers perform their ability to choose one product or service over another and the sellers are free to charge a higher price because of enjoying some power over the market. Due to this, to some extent, sellers act as the price setters in a monopolistic competition market. For instance, the cereals market refers to a market with monopolistic competition structure as the products sold in this market are similar but in terms of flavours and taste, they are slightly different from each other. Another example of monopolistic competition market is toothpaste. The features of monopolistic competition market include free entry and exit, a variation of products, differentiated products, control over price, and heavy expenditure on marketing and promotion as well as on some other sales-oriented activities.

Oligopoly market is characterised by a small number of sellers those who use to sell differentiated or homogeneous products. In some other words, an oligopoly market lies between monopolistic competition and pure monopoly market which is operated by a few sellers who dominate the marketplace and hold control over products’ price. In an oligopoly market, the number of buyers or consumers is much higher compared to the number of sellers. The firms operate under oligopoly market either collaborate together or compete with each other and use their influence on the market to set final selling prices of products which ultimately assist them to maximise their business profits. In this type of market, consumers act as price takers. The features of an oligopoly market include few sellers, large number of buyers, homogeneous as well as heterogeneous products, firms involved in advertising and promotion, intense competition among sellers, easy to exist but there are barriers to enter, and lack of uniformity among companies (in terms of their size of operation).

Monopoly market structure in something where there only one seller is present. Thus, a single company controls and operates the entire market. The seller holds the power to set price for products as per their own discretion and wishes and consumers have to pay the price as set by the seller. Monopoly market is extremely undesirable as in this type of market structure consumers lose their power as well as each and every the market force becomes irrelevant. In reality, a pure monopolistic market is rare. The features of a monopolistic market include a company acts as an industry itself, the company becomes the price maker, substitutions are not available, demand curve found downward, presence of entry barriers, full control of seller on supply and price. Under a monopolistic market, new companies are not able to enter into the market for free due to some economic and legal barriers like Government regulations and license, a large amount of capital requirement, and complex technology.

Significance of Market Structure on Economy

The concept attached to market structure is fundamental to economics as well as in marketing. Both of these two disciplines are solely concerned with decision making which strategic in nature. In the analysis of decision-making, market structure plays a vital role due to its impact on decision-making environment. The characteristics and extent of competition (monopoly, oligopoly, perfect competition) in a market affect the behaviour of the actors. Market structure influences the pricing of products because it defined as the interconnections of several elements that bind buyers, sellers, and products together. The elements that interconnect sellers, buyers, and products together are as follows –

• number of sellers or buyers or both

• selling/buying strength of the agents (sellers and buyers) and the ability of sellers and buyers to influence the final price of products

• potential collusion among sellers and buyers

• level of production

• forms and degree of competition in a market

• degree of differentiation in relation to product and services sellers use to offer

• ease of exit from or entry to the market

Different forms of market structure influence a country’s economy in a different way. A market formed under perfect competition always supports consumers as it reduces the degree of customer exploitation by companies. This is because in a perfect competition market structure sellers are not allowed to practice the power of monopoly pricing and for this reason, they do not influence products’ price i.e. they are not able to charge a higher price for the same product than the normal price from consumers. It is a much more idealised structure of a market than other market structures as it ensures efficient resource allocation which is highly significant for a country’s economic development. Such efficiency is resource allocation is achieved because a company produces exactly the quantity of product which it needs for maximizing its profit that ultimately establishes equality between marginal cost and price. On the other side, a monopolistic market structure is not acceptable, specifically by consumers. Usually, this particular market structure is discouraged in the market economies as the negative impacts on the economy are well-recognised.